Abdelrahman Khodeir Private Office

Dubai Investment Opportunities

Premium Hospitality Tower Sheikh Zayed Road Corridor

1,015-key operational hospitality tower generating AED 231M annual revenue. Exclusive institutional-grade asset in Dubai's premier business corridor.

Asset Highlights

Execute Confidentiality Agreement

Complete this form to receive the signed NDA and access detailed asset information.

By typing your name, you agree to be legally bound by this NDA

NDA Summary:

- • All information shared remains strictly confidential for 2 years

- • Information may only be used for evaluation of this specific investment opportunity

- • No disclosure to third parties without written consent

- • Return or destruction of materials upon request

Investment Thesis

This premium hospitality tower represents a rare opportunity to acquire a fully operational, institutional-grade asset in Dubai's most strategic corridor. With 1,015 keys generating AED 231M in annual revenue, this asset offers immediate cash flow with significant capital appreciation potential.

Strategic Advantages

Operational Scale

Rare 1,000+ key tower in central Dubai with proven operational track record

Revenue Diversification

Hybrid model balancing short-stay hotel income with stable long-term leases

Brand Strength

Operated by international hospitality brand, ensuring professional management standards

Prime Location

Direct metro access in Dubai's business and tourism corridor

Key Metrics

Contact Information

Financial Analysis

Revenue Breakdown

Investment Returns

Valuation Matrix (Income Capitalization Method)

| NOI / Cap Rate | 9% Cap | 8% Cap | 7% Cap |

|---|---|---|---|

| {row.noi} | {row.cap9} | {row.cap8} | {row.cap7} |

At AED 800M asking price, buyer enters below market replacement cost with potential 30–40% capital upside depending on cap rate compression and operational optimization.

Location & Area Overview

Strategic Corridor Position

Located along Sheikh Zayed Road in Dubai's premier business district, the property benefits from exceptional connectivity and high-demand location fundamentals.

Sheikh Zayed Road Frontage

Direct access to Dubai's main artery with maximum visibility

Metro Connectivity

Walking distance to Dubai Metro Red Line stations

Business Hub Proximity

Minutes from DIFC, Business Bay, and Internet City

Area Map

Barsha Heights District

Interactive map showing property location,

metro stations, and key landmarks

Area Photography

Sheikh Zayed Road

Corridor View

Metro Station

Proximity

Surrounding

Business District

*High-resolution imagery and detailed site photography available post-NDA execution

Site Configuration Diagram

Tower Configuration

Site Access & Amenities

*Detailed architectural plans, engineering reports, and 3D site models available in data room post-NDA

Transaction Process

Next Steps

Initial Interest & NDA

Submit expression of interest and execute confidentiality agreement

Proof of Funds

Provide evidence of financial capacity for AED 800M acquisition

Data Room Access

Review audited financials, STR reports, and management agreements

Due Diligence & Offer

Complete technical and legal due diligence, submit binding offer

Requirements

Qualified Investors Only

Strategic buyers or institutional investors with proven hospitality investment track record

Financial Capacity

Demonstrated ability to complete AED 800M transaction with appropriate financing or cash

Confidentiality

All information shared under strict confidentiality agreement

Ready to Proceed?

This exclusive opportunity requires immediate qualification and NDA execution.

Description

Al Jaddaf Plot (69,199 ft²)

mixed use plot in sama al jaddaf g+14

1Senior Real Estate Development Consultant | Dubai

Executive Summary

This feasibility assesses a 69,199 ft² freehold plot in Al Jaddaf for a G+14 mixed-use scheme (95 % efficiency, 1.5 × BUA). Base-case GDV of AED 945.8 M vs. TDC of AED 647.2 M yields profit of AED 298.5 M (ROI 46.1 %, IRR ≈ 28.8 %). Conservative and optimistic scenarios deliver ROI of 31.5 % and 60.7 %, respectively. Key go-no-go: lock conversion-fee exposure, secure interim-title acceptance, and finalize escrow/legal framework.

1. Location Analysis

Strategic Position: Western Bur Dubai, waterfront on Dubai Creek, 10 min to Downtown and DXB Airport via Sheikh Zayed/Al Khail Roads.

Infrastructure: Upcoming Etihad Rail station in Al Jaddaf; Urban Tech District (140,000 m² hub) by 2030 oai_citation:0‡bhomes.com.

Connectivity: METRO proximity (Creek Station), arterial road access, DEWA/Etisalat networks.

Demographics: Population ~7,747 (2023), annual growth ~5 % oai_citation:1‡citypopulation.de.

2. Market Analysis

Off-plan Prices: Median AED 1,850/ft² in Q2-25 (–2 % QoQ) across existing stock oai_citation:2‡dxbinteract.com.

New Launches: Apartments at AED 2,596/ft² (Azizi Creek average) and retail at AED 6,094/ft².

Demand Drivers: Waterfront living, cultural landmarks (Ductac, Opera Park), corporate tenants in nearby Business Bay.

Comparables: Azizi Creek, Binghatti Ivory, Binghatti Avenue trading at AED 1,280–1,790/ft² for secondary stock.

3. Regulatory Framework

Freehold Conversion

DLD Form F; 30 % fee of valuation (capped) under DLD announcement Jan 2025.

Escrow Law

Law 8 (2007) mandates DLD-regulated escrow for buyer funds.

Building Permits

Dubai Municipality multi-storey approval ~8–12 weeks (concept, technical review, final)

Occupancy Permit

Issued post-construction; valid 4 years. Knowledge Dirham & Innovation Dirham apply dda.gov.ae.

Height & Zoning

G+14 per master plan; setbacks and podium coverage per DDA.

4. Technical Feasibility

| Spec | Value |

|---|---|

| Plot Area | 69,199 ft² |

| Max. GFA | 369,000 ft² |

| Efficiency | 95 % |

| BUA (× GFA) | 1.5 × ⇒ 553,500 ft² |

| Net Saleable Area | 350,550 ft² |

| Retail Component | 3 % ⇒ 10,516.5 ft² |

| Residential Area | 340,033.5 ft² |

| Parking | 1.2 spaces/unit |

| Geotech | Piled foundations near creek; standard for waterfront sites. |

5. Financial Analysis

5.1 Development Costs

| Category | AED |

|---|---|

| Acquisition | 167,681,043 |

| Hard Costs | 342,893,250 |

| Soft Costs | 136,665,590 |

| TDC | 647,239,883 |

5.2 Revenue & Profit

| Segment | Area (ft²) | Psf (AED) | Revenue (AED) |

|---|---|---|---|

| Residential | 340,033.5 | 2,595.83 | 882,669,160 |

| Retail | 10,516.5 | 6,000.00 | 63,099,000 |

| Total GDV | 350,550 | 2,696.42 | 945,768,160 |

- Developer Profit: 298,528,277

- ROI: 46.1 %

- IRR: ≈ 28.8 % over 25 months

5.3 Sensitivity

| Scenario | Psf Resi/Retail | GDV (AED) | Profit (AED) | ROI |

|---|---|---|---|---|

| Conservative | 2,336 / 5,400 | 851,191,344 | 203,951,461 | 31.5 % |

| Base Case | 2,596 / 6,000 | 945,768,160 | 298,528,278 | 46.1 % |

| Optimistic | 2,856 / 6,600 | 1,040,344,976 | 393,105,096 | 60.7 % |

6. Risk Assessment

| Risk | Severity | Mitigation |

|---|---|---|

| Fee revision ↑ (30 % cap) | Medium | Fee-cap clause; dual-cheque lodging |

| Permit delays | Medium | DM approval timeline tracked; penalty clause |

| Market price volatility | Medium | Sensitivity; conservative underwriting |

| Cost inflation | Low–Med | Contingency 5 %; fixed‐price contracts |

| Interim title acceptance | Low | Written master-developer confirmation |

7. Implementation Timeline

| Milestone | Duration |

|---|---|

| Pre-dev & Approvals | 0–4 months |

| Construction | 5–22 months |

| Sales Launch | 18 months |

| Handover | 23–30 months |

8. Recommendations

- Proceed on base case: strong returns, manageable risks.

- Lock conversion-fee exposure with capped valuation certificate.

- Finalize escrow & legal: include fee-cap, NOC-timelines, default interest, long-stop dates.

- Secure master-developer sign-off for interim title permit usage.

- Mobilize funding: commit equity AED 338.9 M; explore senior debt for 50 % of hard costs.

This analysis underpins a robust investment decision: Al Jaddaf’s growth trajectory, combined with compelling financial returns, supports advancing to SPA negotiation and permit filings.

- Land, Mixed Use, Multifamily

Property Type

- 69000

sqft

Property Documents

Property Overview

- Property ID HZ38

- Price

- POA

- Property Size 69000 sqft

- Land Area GFA 369 990 sqft

- Property Status For Sale

- Property Type Land, Mixed Use, Multifamily

Energy Ratings

Top amenities

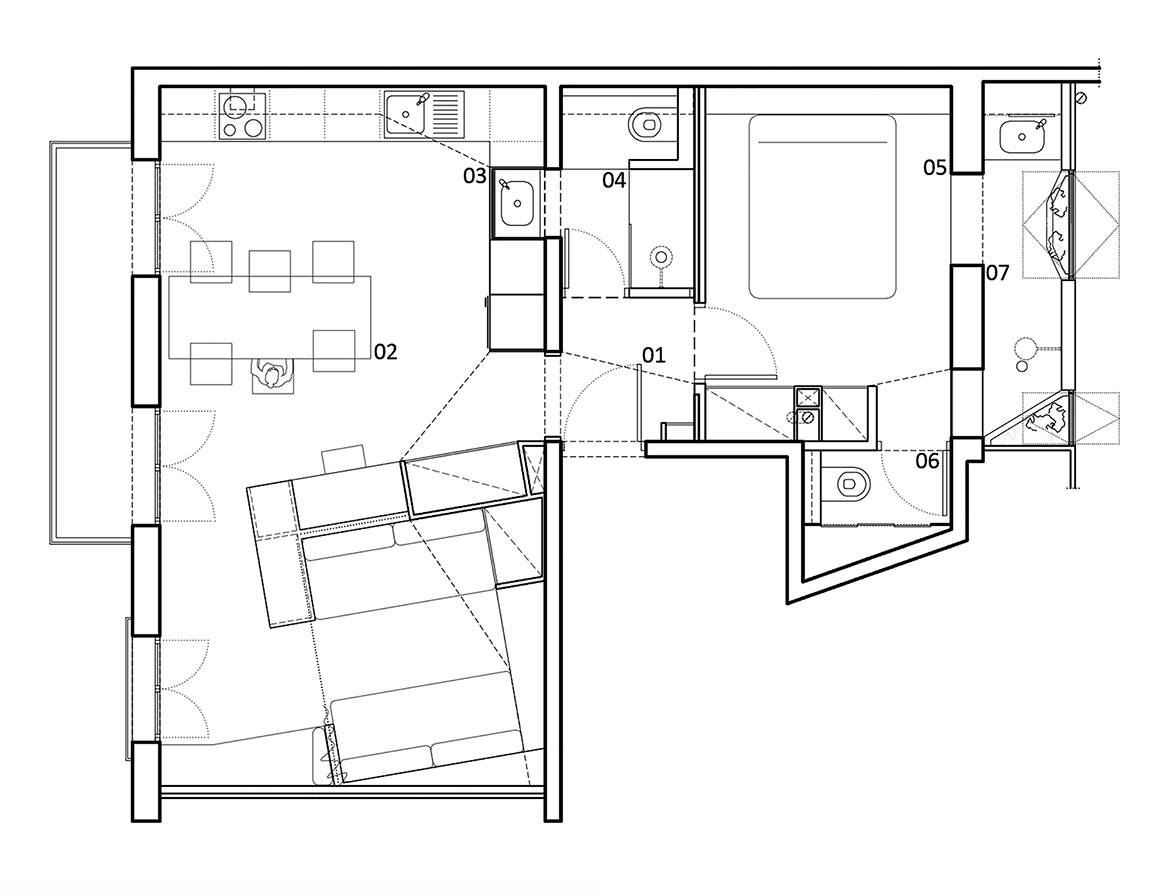

Layout Details

- Size: 1267 Sqft

- 670 Sqft

- 530 Sqft

- Price: AED1,650

Description:

Plan description. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat.

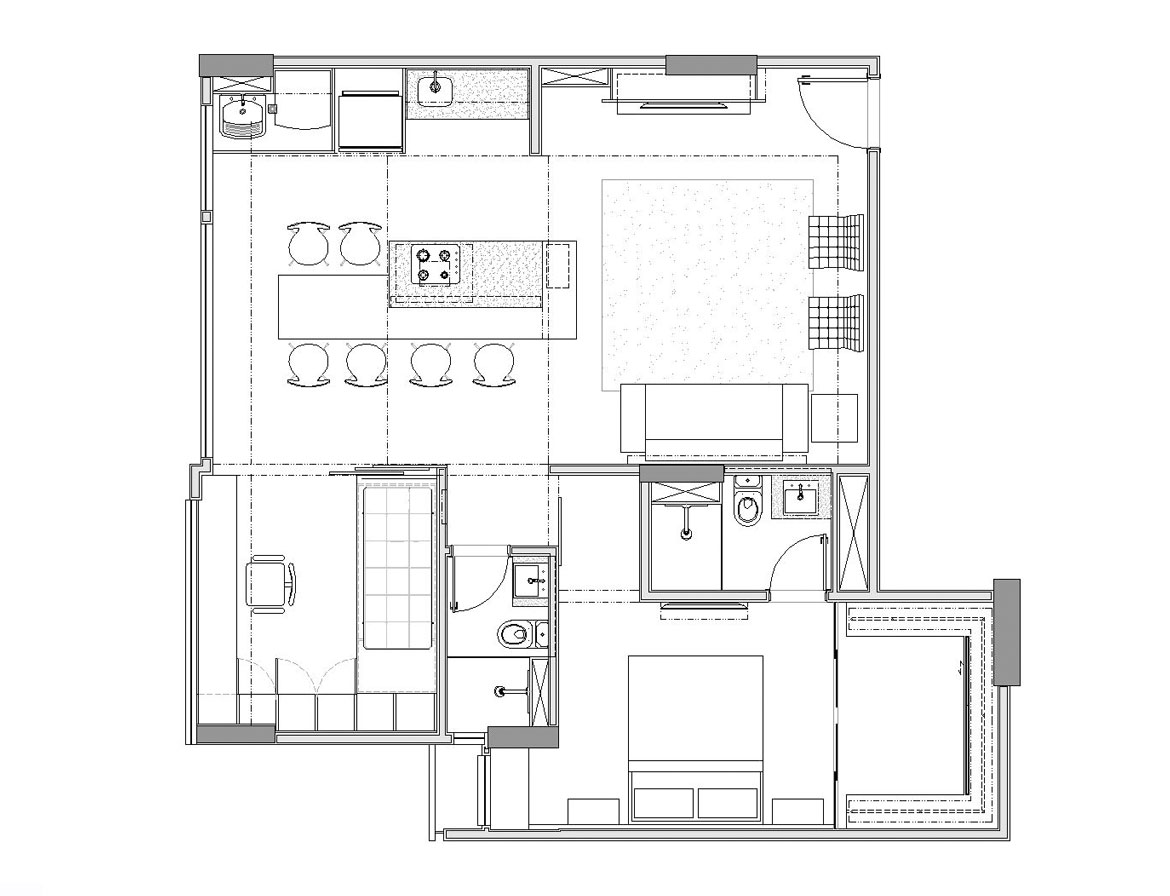

- Size: 1345 Sqft

- 543 Sqft

- 238 Sqft

- Price: AED1,600

Description:

Plan description. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat.

Estimate Payments

- Down Payment

- Loan Amount

- Monthly Mortgage Payment

- Property Tax

- Home Insurance

- PMI

- Monthly HOA Fees

Schedule a visit

Immersive Experience

Get Expert Assistance

Similar Listings

G+2 plot for sale shk zayed road

- AED2,329,000

- 3100 sqft

Commercial for Lease

- AED12,500/mo

- Bath: 1

- 1987 sqft

Shopping Center / Mall for Sale

- AED20,000,000/mo

- Bath: 1

- 75000 sqft