Abdelrahman Khodeir Private Office

Dubai Investment Opportunities

Premium Hospitality Tower Sheikh Zayed Road Corridor

1,015-key operational hospitality tower generating AED 231M annual revenue. Exclusive institutional-grade asset in Dubai's premier business corridor.

Asset Highlights

Execute Confidentiality Agreement

Complete this form to receive the signed NDA and access detailed asset information.

By typing your name, you agree to be legally bound by this NDA

NDA Summary:

- • All information shared remains strictly confidential for 2 years

- • Information may only be used for evaluation of this specific investment opportunity

- • No disclosure to third parties without written consent

- • Return or destruction of materials upon request

Investment Thesis

This premium hospitality tower represents a rare opportunity to acquire a fully operational, institutional-grade asset in Dubai's most strategic corridor. With 1,015 keys generating AED 231M in annual revenue, this asset offers immediate cash flow with significant capital appreciation potential.

Strategic Advantages

Operational Scale

Rare 1,000+ key tower in central Dubai with proven operational track record

Revenue Diversification

Hybrid model balancing short-stay hotel income with stable long-term leases

Brand Strength

Operated by international hospitality brand, ensuring professional management standards

Prime Location

Direct metro access in Dubai's business and tourism corridor

Key Metrics

Contact Information

Financial Analysis

Revenue Breakdown

Investment Returns

Valuation Matrix (Income Capitalization Method)

| NOI / Cap Rate | 9% Cap | 8% Cap | 7% Cap |

|---|---|---|---|

| {row.noi} | {row.cap9} | {row.cap8} | {row.cap7} |

At AED 800M asking price, buyer enters below market replacement cost with potential 30–40% capital upside depending on cap rate compression and operational optimization.

Location & Area Overview

Strategic Corridor Position

Located along Sheikh Zayed Road in Dubai's premier business district, the property benefits from exceptional connectivity and high-demand location fundamentals.

Sheikh Zayed Road Frontage

Direct access to Dubai's main artery with maximum visibility

Metro Connectivity

Walking distance to Dubai Metro Red Line stations

Business Hub Proximity

Minutes from DIFC, Business Bay, and Internet City

Area Map

Barsha Heights District

Interactive map showing property location,

metro stations, and key landmarks

Area Photography

Sheikh Zayed Road

Corridor View

Metro Station

Proximity

Surrounding

Business District

*High-resolution imagery and detailed site photography available post-NDA execution

Site Configuration Diagram

Tower Configuration

Site Access & Amenities

*Detailed architectural plans, engineering reports, and 3D site models available in data room post-NDA

Transaction Process

Next Steps

Initial Interest & NDA

Submit expression of interest and execute confidentiality agreement

Proof of Funds

Provide evidence of financial capacity for AED 800M acquisition

Data Room Access

Review audited financials, STR reports, and management agreements

Due Diligence & Offer

Complete technical and legal due diligence, submit binding offer

Requirements

Qualified Investors Only

Strategic buyers or institutional investors with proven hospitality investment track record

Financial Capacity

Demonstrated ability to complete AED 800M transaction with appropriate financing or cash

Confidentiality

All information shared under strict confidentiality agreement

Ready to Proceed?

This exclusive opportunity requires immediate qualification and NDA execution.

Description

‣ Top-line KPI band

Cost Performance Index (CPI) for the current month and cumulative to-date, plus three “at-completion” forecasts: Estimate‐to-Complete (ETC), Estimate-at-Completion (EAC) and Variance at Completion (VAC). A CPI above 1.00 shows you are spending less than the earned value; below 1.00 signals a cost over-run.

‣ S-curve (line chart)

Planned cumulative EPC drawdowns (baseline) versus actual certificates paid. A diverging gap after Month 5 is the first visual alarm that cash is leaving faster than value is being created.

‣ Monthly CPI trend (bar-over-line)

Bars: monthly CPI.

Line: rolling three-month average.

A two-month dip under 0.90 triggers the red flag in your project controls procedure.

‣ Milestone variance table

| Milestone | Planned AED M | Actual AED M | Variance % | Traffic light |

|---|---|---|---|---|

| Sub-structure complete | 11.2 | 12.4 | +10.7 % | 🔴 |

| Podium slab cast | 18.6 | 18.1 | –2.7 % | 🟢 |

‣ Cost-category pie

Hard cost spend split (structure, MEP, façade, preliminaries) against budget to confirm whether overruns are systemic or isolated.

‣ Cash-flow vs loan-facility gauge

Shows % of construction loan drawn, remaining head-room, and whether you are approaching DSCR covenants.

Why it matters

- Early-warning radar – CPI is earned-value-based, not accountant-based. A falling CPI tells you material over-runs weeks before the quantity surveyor’s monthly report lands, giving time to cut scope or renegotiate rates.

- Capital-call discipline – Investors and lenders release funds against the EPC drawdown schedule. A live dashboard proves you are hitting physical progress, so money arrives on time and the contractor’s cash chain stays intact.

- Pricing power – If costs creep while sales prices are flat, ROC collapses sharply (see sensitivity table). Real-time cost visibility lets you re-price remaining inventory or re-sequence sales launches before profit evaporates.

- Governance – Dubai’s larger banks now require monthly earned-value curves on projects above AED 300 M. A dashboard satisfies that compliance in one screenshot.

Why we set a 75 % Return-on-Cost hurdle

• Risk buffer – Mid-rise mixed-use in JVC is higher-beta than Downtown plots. A 75 % ROC equates to ±35 % net profit margin; that cushion absorbs a simultaneous 10 % sale-price drop and 12 % cost inflation while still clearing the 60 % committee minimum.

• Equity multiple – 75 % ROC over a 30-month programme converts to roughly a 2.0× equity multiple and an un-geared IRR near 24 %. That meets the threshold private-office investors use for Dubai secondary locations (they benchmark against Downtown/Marina deals returning 18-20 % IRR but with lower absorption risk).

• Finance leverage – Banks will typically lend 55-60 % of cost. Hitting 75 % ROC means you can service debt even if absorption slows to 70 % of forecast, keeping the project clear of cash-sweep clauses.

• Negotiating posture – A visible 75 % target signals to the landowner and contractor that you have walk-away power if land or EPC terms erode the economics. It frames negotiations around data, not sentiment.

- Land

Property Type

- 1

Bedroom

- 1

Bathroom

- 1

Garage

- 2360

sqft

- 2016

Year Built

Property Documents

Property Overview

- Property ID HZ45

- Price AED2,800,000

- Property Size 2360 sqft

- Land Area 6000 sqft

- Bedroom 1

- Bathroom 1

- Garage 1

- Garage Size 200 SqFt

- Year Built 2016

- Property Status For Sale

- Property Type Land

Energy Ratings

- Energetic class: A+

- Global Energy Performance Index: 92.42 kWh / m²a

- Renewable energy performance index: 0.00 kWh / m²a

- Energy performance of the building: 92.42 kWh / m²a

- EPC Current Rating: 52

- EPC Potential Rating: 89

- 92.42 kWh / m²a | Energy class A+A+

- A

- B

- C

- D

- E

- F

- G

- H

Top amenities

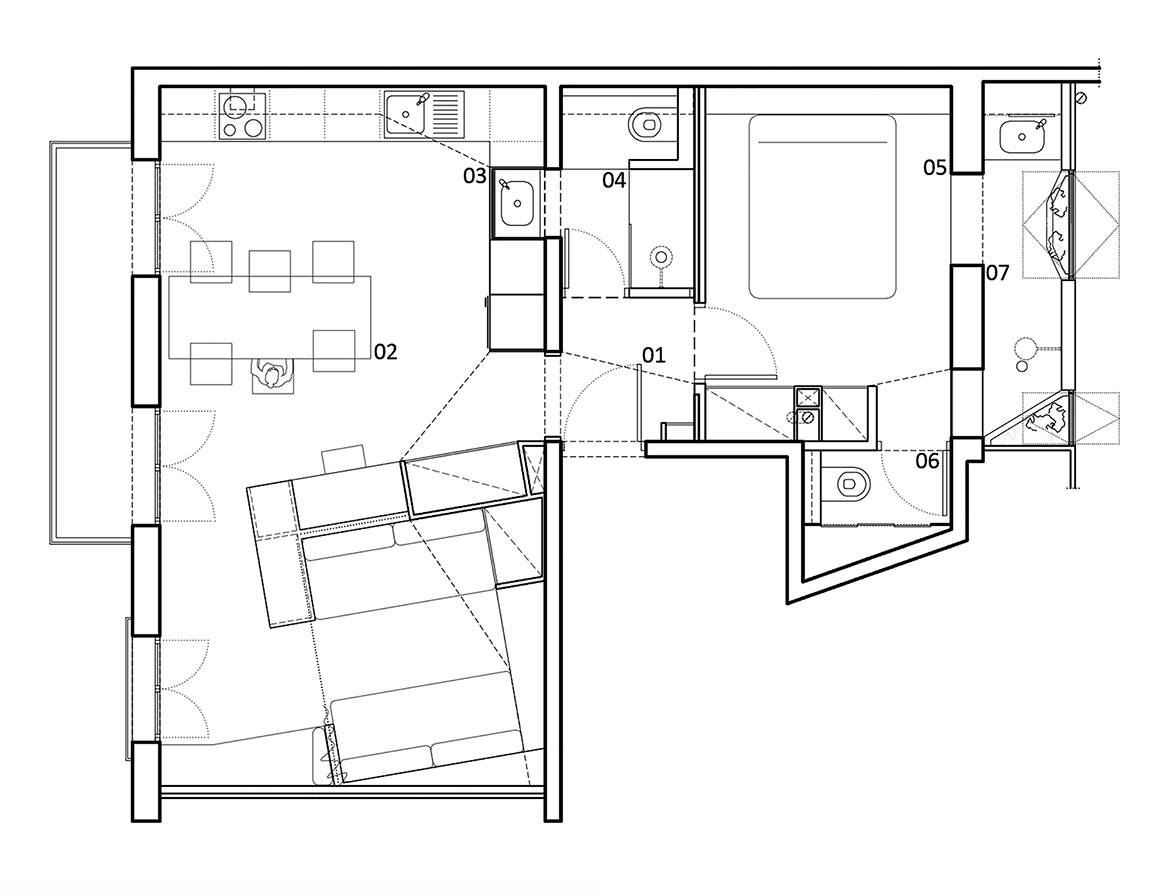

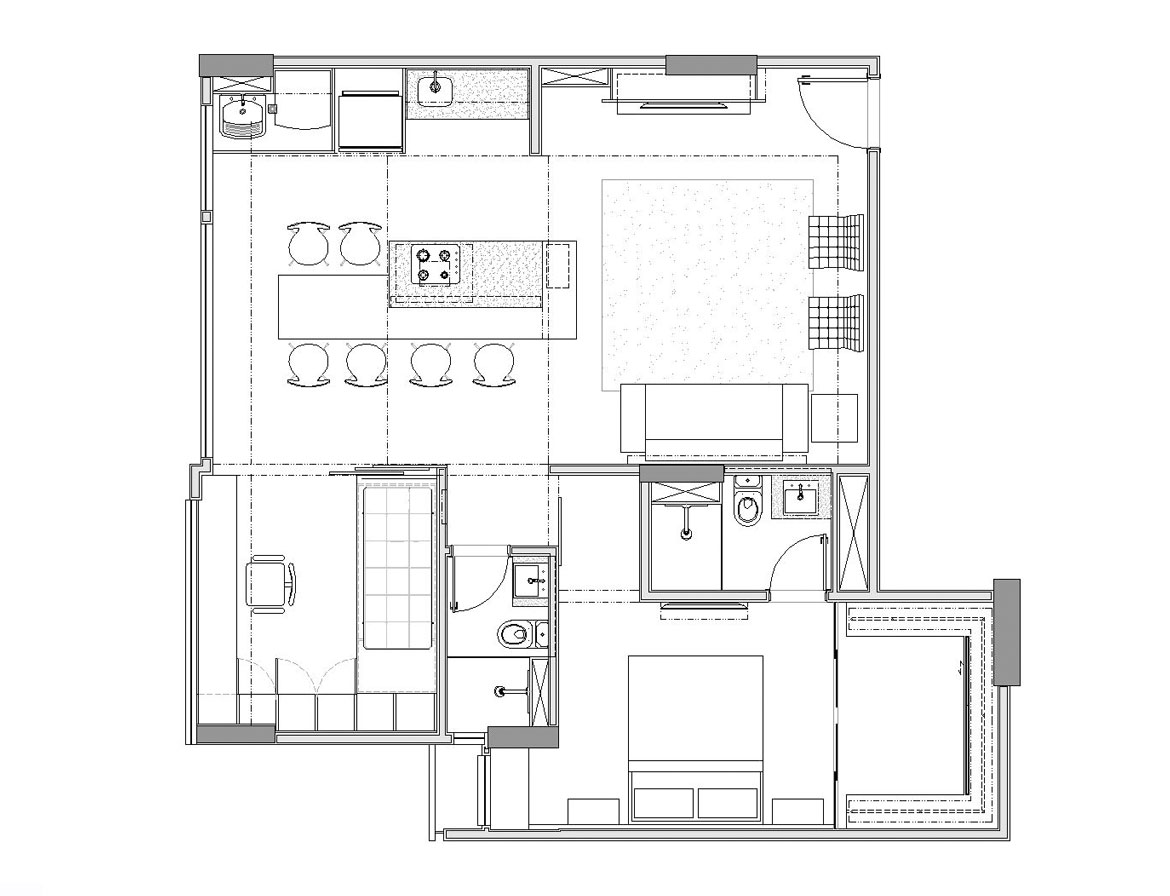

Layout Details

- Size: 1267 Sqft

- 670 Sqft

- 530 Sqft

- Price: AED1,650

Description:

Plan description. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat.

- Size: 1345 Sqft

- 543 Sqft

- 238 Sqft

- Price: AED1,600

Description:

Plan description. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat.

Estimate Payments

- Down Payment

- Loan Amount

- Monthly Mortgage Payment

- Property Tax

- Home Insurance

- PMI

- Monthly HOA Fees

Schedule a visit

Your information

Immersive Experience

Get Expert Assistance

- Mike Moore

- View Listings

Similar Listings

G+2 plot for sale shk zayed road

- AED2,329,000

- 3100 sqft

mixed use land in dubai

- POA

- 69000 sqft

Commercial for Lease

- AED12,500/mo

- Bath: 1

- 1987 sqft

Contact me

- Mike Moore

- View Listings

- Mike Moore

- View Listings